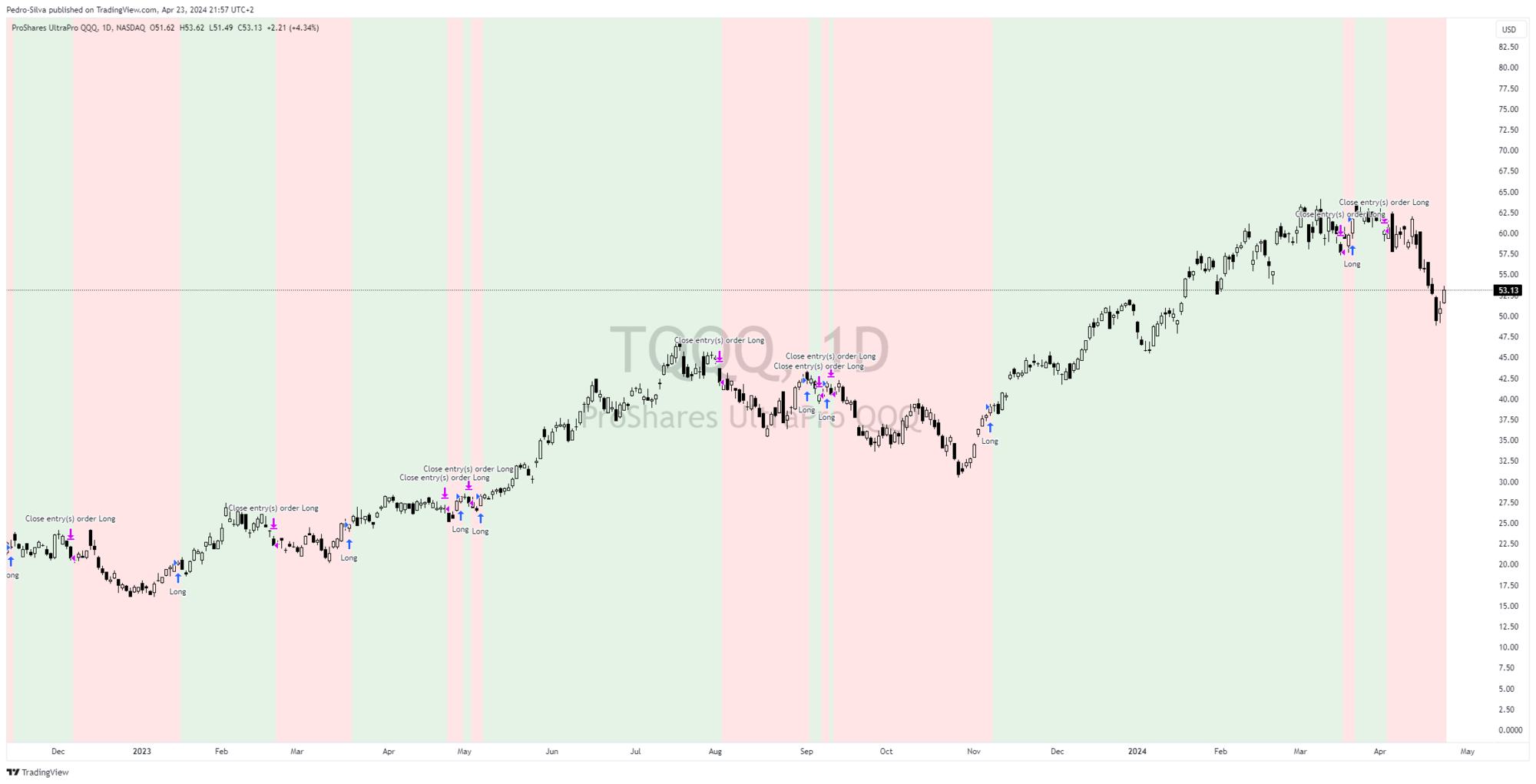

Understanding Alpha Signals: Trend Following vs. Catching Tops and Bottoms

Alpha Signals captures market trends by triggering signals when a trend is underway, rather than attempting to time market tops and bottoms.

The Alpha Signals systematic trading strategy is designed to generate profitable trades by capturing the meat of market trends, rather than attempting to perfectly time entries and exits at market tops and bottoms. This approach, known as trend following, is a core principle of the Alpha Signals methodology.

Trying to buy at the absolute bottom or sell at the absolute top of a market move is a tempting concept, but in practice it is extremely difficult to achieve consistently. Even the most experienced traders struggle to time the market with such precision. Instead, the Alpha Signals strategy focuses on identifying when an uptrend is underway and then riding that trend for the majority of the move.

The strategy uses a hand-picked combination of technical indicators and market analysis to generate buy and sell signals. A buy signal is triggered when the system detects that an uptrend has been established and has a high probability of continuing. Conversely, a sell signal is generated when the system determines a downtrend is in force.

By waiting for confirmation that a trend is in progress, the Alpha Signals strategy may give up some of the potential profits that would come from buying the absolute bottom or selling the absolute top. However, this approach has several key benefits:

- Higher win rate: By trading in the direction of the prevailing trend, the strategy increases the probability that any given trade will be profitable.

- Larger profit potential: Catching the meat of the move allows for the possibility of riding a trend for an extended period and capturing a larger profit.

- Reduced risk: Waiting for trend confirmation helps avoid whipsaw losses that can occur when trying to pick tops and bottoms in choppy markets.

- Systematic approach: Clear rules for entry and exit remove the emotion and guesswork from trading decisions.

The Alpha Signals strategy has been extensively backtested and has demonstrated the ability to generate consistent profits over time by successfully capturing major market trends. While it may not provide the adrenaline rush of perfectly timing market reversals, the strategy's disciplined trend following approach has proven to be a robust and reliable way to grow capital in the long run.

In summary, the Alpha Signals systematic trading strategy is not designed to buy at the bottom and sell at the top, but rather to profit by capturing the majority of major market trends. By following trends instead of trying to predict them, the strategy aims to generate strong returns while keeping risk under control.